Short-Term Trading Signals

Short-Term Trading Signals For Stocks & ETFs are algorithm-generated trading signals for timing the buying and selling of stocks and ETFs. The presented trading signals were selected from the most active and volatile equities listed on the NYSE, AMEX, and NASDAQ stock exchanges.

• The underlying signal generator makes all of the trading decisions for you … all you need to know is how to place an order.

• Tomorrow’s Buy and Sell signals for the twenty stocks which are most likely to result in profitable trades over the next few days are updated to the app at about 10:00 PM ET … the night before the next trading day’s regular trading hours begin.

• Trades typically last for 3 to 10 market days ... short-term trades.

• The Signal Page indicates whether to execute your trade on tomorrow’s Open or Close, or to hold an existing trade. It is the job of the signal generator to make all of the decisions. Just place your orders, and go have a life.

How is it done? Initially, from amongst thousands of stocks and ETFs, algorithms develop a winning trading strategy for those stocks which have a repeating “rhythm” of price movement over approximately the past 6 months. Based on those results, a Signal Strength is determined for each tested stock (awarding higher values to continued good performance). Finally, the stocks are sorted by Signal Strength, and the twenty stocks with the highest Signal Strengths are displayed in the app.

If the profit performance of a stock continues on track, its signal strength will remain high, and it will remain in the list of top twenty stocks. However, should a stock’s performance begin to deteriorate, then its signal strength will quickly decline. Each weekend, the three weakest stocks in the list are subject to being replaced by stronger performers.

The underlying concept: Trade only the stocks with the highest Signal Strengths ... they are the ones which are performing the best right now, and they have the highest probability of near-term continued good performance.

In the Short-Term Trading Signals For Stocks & ETFs app, the user may select to view either Long Only or Long & Short trading signals … to suit your style of trading. The trading signals have been grouped into three main categories:

• S&P 500 – Only the stocks comprising the S&P 500 index are included in this group of trading signals.

• Volatile Stocks – All stocks and ETFs listed on the NYSE, AMEX, and NASDAQ stock exchanges are evaluated for the best trading signals.

• Trading System – For the most recent three months, signals and results are listed assuming that trades were made whenever a stock was ranked amongst the three strongest in the stock list.

For each category, before the next trading day, the following information is posted:

• Signals – Tomorrow’s trading signals for twenty top performing stocks and ETFs.

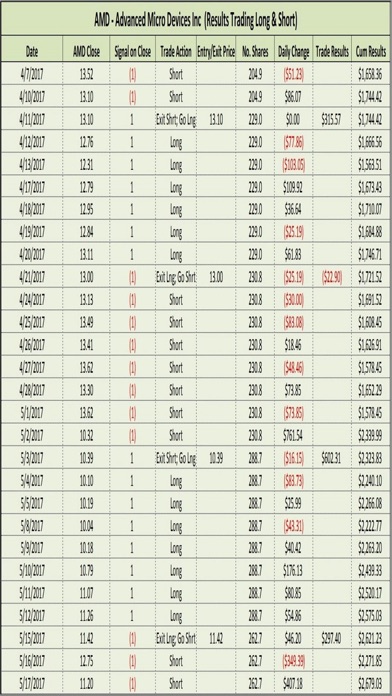

• Results – Chart of equity results for the selected stocks for about the last six months.

• Trades – Trade history for the selected stocks for the recent three months.

Our app is free to download and includes a 14-day trial subscription to our trading signals. A monthly subscription is required in order to continue receiving our daily trading signals via the app.

• Payment will be charged to iTunes Account at confirmation of purchase

• Subscription automatically renews unless auto-renew is turned off at least 24-hours before the end of the current period

• Account will be charged for renewal within 24-hours prior to the end of the current period, and identify the cost of the renewal

• Subscriptions may be managed and auto-renewal may be turned off by going to Account Settings after purchase

• Any unused portion of a free trial period, will be forfeited when the user purchases a subscription to that publication, where applicable

Privacy Policy – https://www.ShortTermTradingSolutions.com/Privacy-Policy/

Disclaimer – http://www.ShortTermTradingSolutions.com/Disclaimer/

Contact – [email protected]